In an increasingly digital world, the concept of passive income has gained significant traction among savvy investors looking to maximize their earnings without tying up their time in traditional work. Digital assets, which include cryptocurrencies, NFTs, and other online investments, have emerged as innovative vehicles for generating passive income. This article delves deep into the various strategies that can help you unlock passive income through digital assets.

Unlocking passive income through digital assets is an emerging opportunity for creatives and entrepreneurs alike. By leveraging tools such as varieties of bag mockups, you can enhance your product presentations and potentially drive revenue streams with minimal ongoing effort.

Table of Contents

Understanding Digital Assets

Before diving into how to generate passive income through digital assets, it’s essential to understand what they are. Digital assets refer to intangible assets that exist in a digital format. They have value and can be owned or traded. Common examples include:

- Cryptocurrencies (e.g., Bitcoin, Ethereum)

- Non-Fungible Tokens (NFTs)

- Digital artworks

- Online courses

- Web domains

Why Choose Digital Assets for Passive Income?

Investing in digital assets can be particularly attractive for several reasons:

- Flexibility: Digital assets can be bought, sold, or traded at any time, providing liquidity that traditional assets often lack.

- Low Barrier to Entry: Many digital assets require minimal investment, allowing even novice investors to get started.

- Global Market: The digital asset market operates 24/7, giving investors access to a global marketplace.

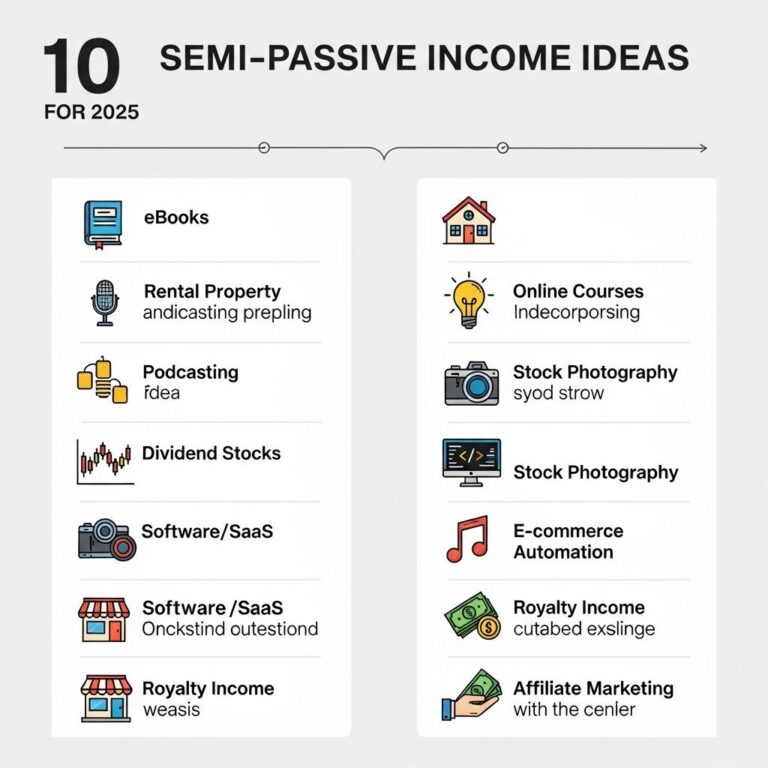

Strategies for Generating Passive Income

There are multiple strategies for leveraging digital assets to create passive income streams. Here are some of the most effective:

1. Staking Cryptocurrencies

Staking involves locking up your cryptocurrency in a wallet to support the network’s operations, such as validating transactions. In return, you earn rewards in the form of additional cryptocurrency. Here’s how to get started:

- Choose a cryptocurrency that supports staking (e.g., Cardano, Ethereum 2.0).

- Set up a staking wallet.

- Transfer your coins to the staking wallet.

- Select a staking pool and stake your coins.

Benefits of staking include:

- Earn rewards without selling your assets.

- Contribute to network security and efficiency.

2. Yield Farming

Yield farming is an investment strategy that involves lending or staking your cryptocurrency in exchange for interest or rewards. This method is most commonly used in decentralized finance (DeFi) platforms. Here are the steps to yield farming:

- Select a DeFi platform (e.g., Uniswap, Aave).

- Provide liquidity by depositing your cryptocurrency.

- Earn interest or liquidity tokens as rewards.

Considerations for yield farming:

- Understand the risks, such as impermanent loss.

- Research the platform’s track record before investing.

3. Creating and Selling NFTs

Non-Fungible Tokens (NFTs) have revolutionized the digital art and collectibles market. Artists and creators can monetize their work by minting it as NFTs. To generate passive income through NFTs, follow these steps:

- Create unique digital assets (art, music, or virtual real estate).

- Mint your creations on a blockchain (e.g., Ethereum).

- List your NFTs on various marketplaces (e.g., OpenSea, Rarible).

Tips for NFT success include:

- Promote your artwork on social media.

- Engage with the community to build a following.

4. Affiliate Marketing with Digital Products

Affiliate marketing is a popular method for earning passive income by promoting products or services and earning a commission on sales made through your referral link. To succeed as an affiliate marketer, consider the following:

- Choose a niche aligned with your interests or expertise.

- Join affiliate programs or networks (e.g., Amazon Associates, ShareASale).

- Create content that promotes digital products, such as blogs or videos.

5. Investing in Cryptocurrency Index Funds

For those who prefer a hands-off approach, cryptocurrency index funds are an excellent choice. These funds track a basket of cryptocurrencies, providing diversified exposure without the need to manage individual assets. Here’s how to invest:

- Research various cryptocurrency index funds.

- Open an account with a reputable fund manager.

- Invest a lump sum or contribute regularly.

Risks and Considerations

While there are numerous opportunities to earn passive income through digital assets, it’s crucial to understand the associated risks:

| Risk | Description |

|---|---|

| Market Volatility | Cryptocurrencies are notoriously volatile, which can impact the value of your investments. |

| Regulatory Risks | Changes in regulations can affect the legality and value of certain digital assets. |

| Security Threats | Digital assets are vulnerable to hacking and fraud. |

Conclusion

Digital assets present unique opportunities for generating passive income through a variety of strategies, from staking cryptocurrencies to creating NFTs. However, potential investors must approach this landscape with caution, understanding the risks involved and conducting thorough research. By diversifying your digital asset portfolio and implementing sound investment strategies, you can establish a steady stream of passive income in the digital age. Start exploring these options today to unlock your financial potential!

FAQ

What are digital assets?

Digital assets are online resources that hold value, such as cryptocurrencies, NFTs, digital contracts, and other forms of digital content.

How can I generate passive income from digital assets?

You can generate passive income through methods like staking cryptocurrencies, renting out NFTs, or creating digital products that sell over time.

What are the risks associated with investing in digital assets?

Risks include market volatility, regulatory changes, and the potential for loss due to hacking or fraud.

Is investing in digital assets suitable for everyone?

Not necessarily. It’s essential to assess your financial goals, risk tolerance, and investment knowledge before diving into digital assets.

How do I choose the right digital asset for passive income?

Research the asset’s market performance, utility, community support, and historical trends to make an informed decision.

Can I diversify my digital asset portfolio?

Yes, diversifying your digital asset portfolio can help mitigate risk and enhance potential returns by spreading investments across various types of digital assets.