In today’s fast-paced financial landscape, the allure of accumulating wealth through smart investments has never been more prominent. With the right strategies and insights, anyone can aspire to earn ₹10 lakhs or more. This article delves into various investment avenues, tips for maximizing returns, and the importance of a well-thought-out financial plan.

Table of Contents

Understanding Investment Basics

Before diving into specific investment strategies, it’s essential to understand the basics of investing. Here are some fundamental concepts:

- Risk and Return: Higher potential returns often come with higher risk. Knowing your risk tolerance is crucial.

- Diversification: Spreading investments across various assets can reduce risk and enhance returns.

- Time Horizon: The duration you plan to hold an investment impacts your strategy.

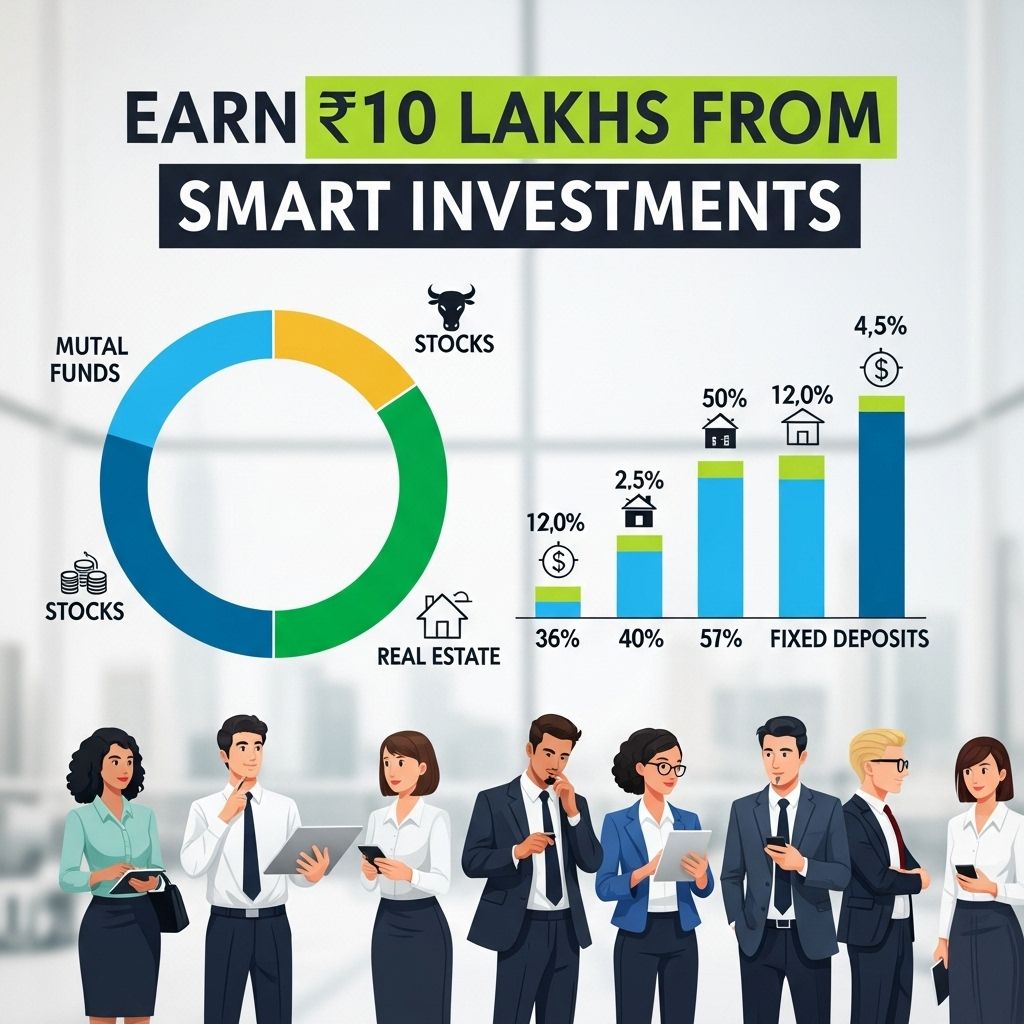

Popular Investment Avenues

There are numerous investment options available today. Here’s a breakdown of some popular avenues:

1. Stock Market

Investing in stocks can yield high returns, especially if you focus on companies with strong fundamentals. Consider the following:

- Research companies extensively.

- Look for growth stocks in emerging sectors like technology or green energy.

- Utilize stock screeners to find undervalued stocks.

2. Mutual Funds

For those who prefer a more hands-off approach, mutual funds can be an excellent option:

- Equity Mutual Funds: Invest primarily in stocks, suitable for long-term growth.

- Debt Mutual Funds: Invest in fixed-income securities, offering more stability.

- Hybrid Funds: Combine both equity and debt for a balanced approach.

3. Real Estate

Real estate can be a lucrative investment opportunity if approached wisely. Key considerations include:

| Factor | Consideration |

|---|---|

| Location | Invest in areas with growth potential. |

| Market Trends | Stay informed about real estate market trends. |

| Rental Yield | Evaluate the potential rental income. |

4. Fixed Deposits and Bonds

For conservative investors, fixed deposits and bonds can provide stable returns:

- Fixed Deposits: Bank savings offering guaranteed returns.

- Government Bonds: Low-risk investment providing regular interest payments.

Strategies for Maximizing Returns

To increase the chances of earning ₹10 lakhs through investments, consider the following strategies:

1. Compound Interest

Investing early and allowing returns to compound over time can significantly increase your wealth. Using the formula:

A = P(1 + r/n)^(nt)

Where:

- A = the future value of the investment/loan, including interest

- P = the principal investment amount

- r = the annual interest rate (decimal)

- n = the number of times that interest is compounded per unit t

- t = the time the money is invested or borrowed for, in years

2. Regular Monitoring

Stay aware of market conditions and regularly monitor your investments. This includes:

- Reviewing financial news

- Tracking performance metrics

- Adjusting your portfolio as necessary

3. Setting Clear Goals

Define clear financial goals, such as:

- Short-term (1-3 years)

- Medium-term (3-5 years)

- Long-term (5+ years)

Creating a Balanced Portfolio

A balanced portfolio is essential for risk management. Consider this sample allocation:

| Asset Class | Percentage Allocation |

|---|---|

| Equity | 60% |

| Debt | 20% |

| Real Estate | 10% |

| Cash and Cash Equivalents | 10% |

This distribution may vary depending on individual risk tolerance and market conditions.

Utilizing Technology for Investment

In today’s digital age, leveraging technology can enhance your investment journey:

- Investment Apps: Use apps for tracking portfolios and making trades on the go.

- Robo-Advisors: Automated investment platforms can create and manage portfolios based on your goals.

- Online Courses: Educate yourself through online platforms offering investment courses.

Conclusion

Investing wisely can lead to substantial wealth accumulation, including the goal of earning ₹10 lakhs. By understanding different investment avenues, employing smart strategies, and leveraging technology, individuals can build a robust financial future. Always remember to conduct thorough research, stay informed, and adapt your strategies as needed to navigate the ever-changing landscape of investments.

FAQ

What are smart investment strategies to earn ₹10 Lakhs?

Smart investment strategies include diversifying your portfolio, investing in mutual funds, stocks, real estate, and considering systematic investment plans (SIPs) for consistent growth.

How long does it typically take to earn ₹10 Lakhs through investments?

The time it takes to earn ₹10 Lakhs through investments varies based on the initial investment amount, market conditions, and investment choices, but it can take several years with disciplined investing.

What types of assets should I invest in to achieve my ₹10 Lakhs goal?

To achieve a goal of ₹10 Lakhs, consider a mix of equities, fixed deposits, mutual funds, and real estate to balance risk and returns.

Are there any risks involved in smart investments?

Yes, all investments come with risks. It’s important to assess your risk tolerance and conduct thorough research or consult a financial advisor before making investment decisions.

Can I invest ₹10,000 monthly to reach ₹10 Lakhs?

Yes, investing ₹10,000 monthly in a well-performing mutual fund or stock market can potentially help you reach ₹10 Lakhs over time, depending on market returns.

What are the tax implications of earning ₹10 Lakhs from investments?

Earnings from investments may be subject to capital gains tax. It’s advisable to consult a tax professional to understand the specific tax implications based on your investment type.