The landscape of income generation is evolving rapidly, and as we move into 2025, the concept of semi-passive income systems is gaining traction among savvy investors and entrepreneurs. By blending technology with smart strategies, individuals can create income streams that require minimal ongoing effort. This article delves into the various methods available to unlock semi-passive income in the coming year, exploring diverse opportunities across different sectors.

Table of Contents

Understanding Semi-Passive Income

Semi-passive income is distinct from both active and fully passive income. It refers to income generated from investments or business activities that require some initial effort or management but can become largely automated over time. This hybrid approach allows individuals to enjoy the benefits of passive income while still engaging with their projects.

Key Characteristics of Semi-Passive Income

- Initial Investment: Requires financial or time investment upfront.

- Ongoing Management: Needs some level of oversight or involvement.

- Scalability: Potential for growth with minimal additional effort.

- Flexibility: Can be adjusted or optimized based on changing market conditions.

Emerging Trends for 2025

As we look ahead to 2025, several trends are shaping the semi-passive income landscape:

1. The Rise of Digital Real Estate

Digital real estate refers to virtual properties such as domain names, websites, and online businesses. The demand for online presence is skyrocketing, leading to a burgeoning market for buying and selling digital assets.

2. Automated Dropshipping

Dropshipping remains a powerful e-commerce model, and with advancements in automation tools, it’s easier than ever to run a dropshipping business with minimal effort.

3. Cryptocurrency Staking

Staking cryptocurrencies involves holding funds in a cryptocurrency wallet to support the operations of a blockchain network. In exchange for this, individuals earn rewards, creating a semi-passive income stream.

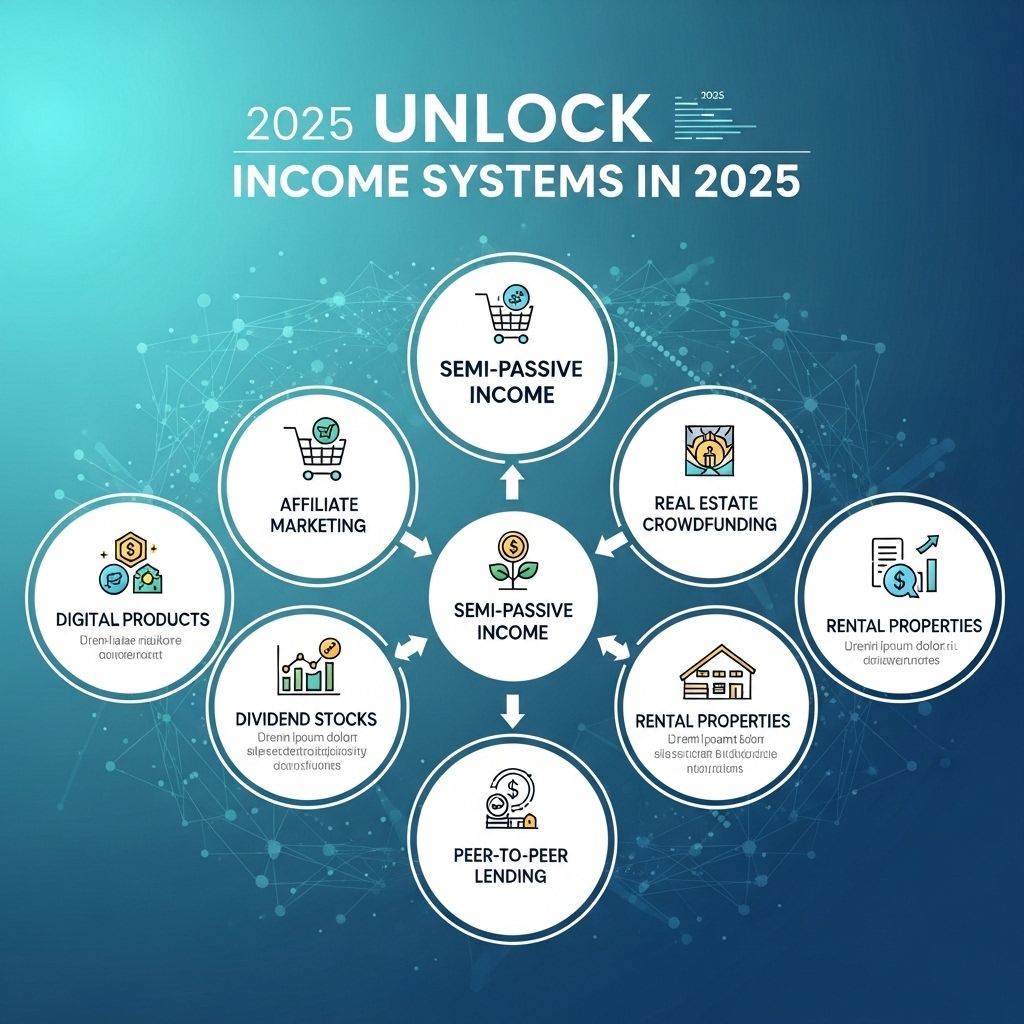

Exploring Income Opportunities

Here are some notable semi-passive income systems that you can explore in 2025:

1. Affiliate Marketing

Affiliate marketing allows you to earn commissions by promoting products or services from other companies. You can create content such as blogs, videos, or social media posts to drive traffic.

Steps to Get Started:

- Choose a niche that interests you.

- Sign up for affiliate programs related to your niche.

- Create valuable content that includes your affiliate links.

- Drive traffic through SEO, social media, or paid ads.

2. Create an Online Course

If you possess expertise in a particular area, creating and selling an online course can be an excellent semi-passive income stream. Once developed, courses can be sold repeatedly without much additional effort.

Benefits of Online Courses:

- Scalability: Reach a global audience.

- Recurring income: Sell the course multiple times.

- Low overhead: Minimal costs involved.

3. Print on Demand

Print on demand (POD) allows you to design custom products like t-shirts and mugs without managing inventory. When a customer makes a purchase, the product is printed and shipped directly to them.

How to Succeed in POD:

- Find a reputable POD provider.

- Create unique designs that appeal to your target audience.

- Market your products through social media and online ads.

Utilizing Technology for Automation

To achieve a semi-passive income, leveraging technology is crucial. Automation tools can help streamline processes, reduce manual effort, and maximize efficiency.

Examples of Automation Tools:

| Tool | Functionality | Cost |

|---|---|---|

| Zapier | Automates tasks between apps | Starting at $19.99/month |

| Mailchimp | Email marketing automation | Free tier available, paid plans start at $10/month |

| Shopify | E-commerce automation | Plans start at $29/month |

Evaluating Risks and Challenges

While semi-passive income systems offer significant opportunities, it’s essential to understand the risks.

Common Risks to Consider:

- Market Volatility: Changes in consumer preferences or market conditions can affect income.

- Initial Investment: Some systems require upfront capital, which may not guarantee returns.

- Management Effort: While semi-passive, these systems still require time and effort to maintain.

Conclusion

As we approach 2025, the potential for semi-passive income systems is vast. By leveraging technology and innovative strategies, you can create income streams that provide financial freedom with minimal ongoing effort. Whether through affiliate marketing, online courses, or digital real estate, the future is ripe with opportunities for those willing to adapt and invest wisely. Start exploring these avenues today to position yourself for success in the evolving economic landscape.

FAQ

What are semi-passive income systems?

Semi-passive income systems are income-generating methods that require minimal ongoing effort after the initial setup, allowing individuals to earn money while focusing on other pursuits.

How can I create a semi-passive income system in 2025?

To create a semi-passive income system in 2025, consider leveraging digital products, affiliate marketing, or real estate investments that automate processes and generate recurring revenue.

What are some examples of semi-passive income streams?

Examples of semi-passive income streams include rental properties, stock dividends, online courses, and print-on-demand merchandise.

Is semi-passive income sustainable long-term?

Yes, semi-passive income can be sustainable long-term if properly managed and diversified, allowing for continuous revenue generation with reduced effort.

What skills do I need to develop a semi-passive income system?

Key skills for developing a semi-passive income system include digital marketing, basic finance management, content creation, and understanding market trends.

Are there risks associated with semi-passive income systems?

Yes, risks such as market fluctuations, changes in demand, and initial investment costs can affect the success of semi-passive income systems.