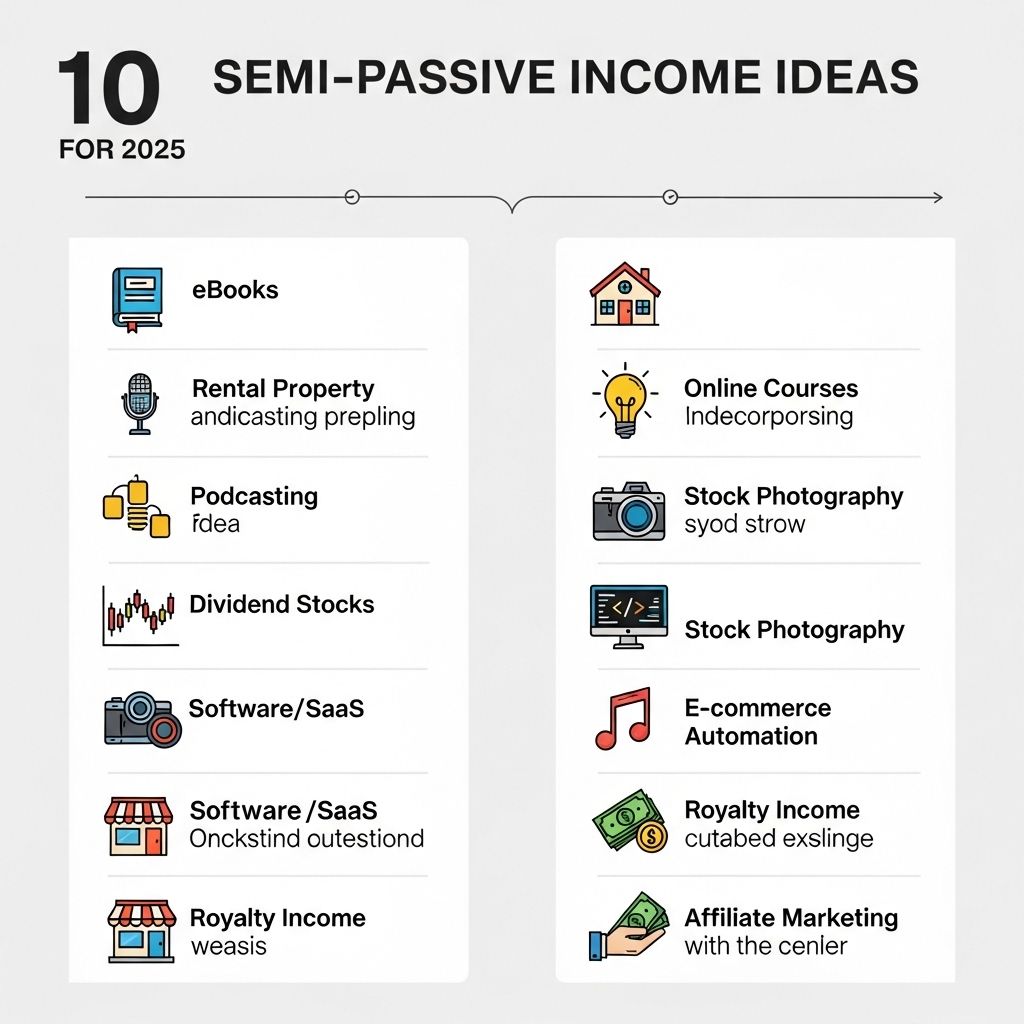

As we navigate the ever-evolving landscape of personal finance and investment strategies, the concept of semi-passive income continues to gain traction among those looking to augment their earnings without committing to traditional employment. In 2025, the avenues for generating this type of income have expanded significantly, thanks to technological advancements and shifts in consumer behavior. This article explores ten innovative semi-passive income ideas that can help you harness your resources effectively while allowing for a degree of flexibility and freedom.

As we look ahead to 2025, the pursuit of semi-passive income streams is more relevant than ever. From leveraging digital assets to investing in innovative business models, there are numerous opportunities for individuals to create sustainable income sources with minimal ongoing effort. Explore creative avenues like realistic bag mockup examples that can elevate your branding and marketing strategies.

Table of Contents

Understanding Semi-Passive Income

Semi-passive income refers to earnings that require some level of effort or management but do not necessitate a full-time commitment. This form of income typically requires initial work or investment upfront, followed by ongoing management or occasional involvement. As the world becomes increasingly digitized, opportunities for generating semi-passive income are abundant.

1. Cryptocurrency Staking

Cryptocurrency staking involves holding a certain amount of cryptocurrency in a digital wallet to support the operations of a blockchain network. In return, stakers earn rewards, typically in the form of additional cryptocurrency. This method is gaining traction due to the popularity of decentralized finance (DeFi). Here’s why you should consider it:

- Growth Potential: As more projects move to a proof-of-stake model, the demand for stakers increases.

- Passive Earnings: Rewards can be substantial; some cryptocurrencies offer 10% or more in annual returns.

- Low Entry Barriers: Many platforms allow you to start staking with as little as $10.

2. Print on Demand

This business model allows you to design customized products that are printed only after an order is placed. This means no inventory management or upfront costs. Consider these steps to get started:

- Choose a niche based on your interests or market research.

- Create designs using graphic design tools.

- Set up an online store on platforms like Shopify or Etsy.

- Partner with a print-on-demand service.

3. Real Estate Crowdfunding

Real estate crowdfunding is a relatively new investment vehicle that allows individuals to invest in real estate projects online. This method offers diversified exposure to real estate without the need to buy property directly. Here’s what to know:

| Advantages | Considerations |

|---|---|

| Low Minimum Investments | Market Risk |

| Diversification | Illiquidity |

| Passive Income Opportunities | Less Control |

4. Affiliate Marketing

Affiliate marketing requires you to promote products or services and earn a commission for every sale made through your referral link. With the right strategy, it can yield significant returns. Here’s how to excel:

Steps to Success

- Choose a niche that interests you and has a strong affiliate program.

- Create quality content that drives traffic to your affiliate links.

- Build an audience through social media or a blog.

- Utilize SEO strategies to improve your visibility.

5. Online Courses and Ebooks

Creating and selling online courses or ebooks is a great way to share your expertise while generating semi-passive income. Here’s how to get started:

- Select a topic you are knowledgeable about.

- Outline your course or ebook content.

- Use platforms like Teachable or Amazon Kindle to publish.

- Market your content through social media and email marketing.

6. Subscription Services

Subscription services provide steady income through recurring payments. This can be applied to various industries, including:

- Content creation (e.g., Patreon, Substack)

- Software (e.g., SaaS products)

- Physical goods (e.g., subscription boxes)

To succeed, focus on delivering consistent value to retain subscribers.

7. Stock Photography

If you have a knack for photography, selling stock images can be a lucrative semi-passive income stream. Consider the following:

Getting Started

- Build a portfolio of high-quality images.

- Upload your images to stock photography websites like Shutterstock or Adobe Stock.

- Promote your portfolio on social media.

8. Vending Machines

Operating vending machines can be an excellent way to generate semi-passive income. Here’s how to approach it:

Key Steps

- Research high-traffic locations.

- Purchase or lease vending machines.

- Stock them with popular snacks or beverages.

- Regularly monitor sales and restock as needed.

9. Dividend Stocks

Investing in dividend-paying stocks can provide a steady stream of income. Here are some tips for selecting the right stocks:

- Look for companies with a strong history of paying dividends.

- Consider the dividend yield and payout ratio.

- Diversify your investments to mitigate risk.

10. Mobile App Development

If you have programming skills or can outsource development, creating a mobile app can be a rewarding venture. Here’s how to maximize your app’s earning potential:

Effective Strategies

- Identify a problem your app can solve.

- Choose a monetization strategy (e.g., ads, in-app purchases).

- Continuously update and improve the app based on user feedback.

Conclusion

In 2025, the landscape for generating semi-passive income is more promising than ever. By exploring these ten ideas, you can leverage your skills, knowledge, and resources to create supplementary income streams while maintaining the flexibility and lifestyle you desire. The key to success in any semi-passive income venture is dedication, strategic planning, and adaptability to changing market trends. Start your journey today!

FAQ

What are some semi-passive income ideas for 2025?

Some semi-passive income ideas for 2025 include real estate crowdfunding, peer-to-peer lending, creating an online course, affiliate marketing, and investing in dividend-paying stocks.

How can I start earning semi-passive income?

To start earning semi-passive income, identify your skills or interests, research income-generating opportunities, and create a plan to invest time or money into those ventures.

Is semi-passive income a reliable source of earnings?

While semi-passive income can provide additional earnings, it often requires initial effort and ongoing management. It’s important to research and choose reliable income sources.

What is the difference between passive and semi-passive income?

Passive income requires little to no effort to maintain after the initial setup, while semi-passive income requires some level of ongoing involvement or management.

Can I scale my semi-passive income sources?

Yes, many semi-passive income sources can be scaled by increasing investment, expanding your audience, or diversifying your income streams.

What skills do I need for successful semi-passive income generation?

Skills that can help in generating semi-passive income include marketing, financial management, online content creation, and networking.