In today’s fast-paced world, saving money can often feel like a daunting task, especially when unexpected expenses arise. However, with the right strategies in place, anyone can save a significant amount of money quickly. This article outlines effective methods to help you save $3,000 in a short period, providing practical tips that can easily fit into your daily routine.

If you’re looking to quickly boost your savings by $3,000, it’s easier than you might think. Here are five actionable steps that can help you reach your goal faster than you ever imagined. Plus, consider utilizing creative resources like using bag mockups for branding to enhance your projects and potentially generate extra income.

Table of Contents

Understanding Your Financial Goals

Before you can effectively save money, it’s crucial to establish clear financial goals. Understanding why you want to save can motivate you to stick to your plan. Here are some common reasons people save:

- Emergency funds

- Travel plans

- Buying a new car

- Home renovations

- Investment opportunities

By identifying your purpose, you can tailor your saving strategies to align with your goals.

Step 1: Create a Budget

A well-structured budget is the foundation for successful saving. Follow these steps to create an effective budget:

Track Your Income and Expenses

Start by listing all your sources of income and your recurring expenses. This will give you a clear picture of your financial situation. You can use apps like Mint or YNAB (You Need A Budget) to simplify this process.

Identify Non-Essential Spending

Review your expenses to pinpoint areas where you can cut back. Consider the following:

- Dining out

- Subscription services

- Cable TV

- Impulse purchases

Allocate a Savings Amount

Once you have a clear understanding of your income and expenses, set a specific amount to save each month. Aim for at least 20% of your income if possible.

Step 2: Automate Your Savings

One of the easiest ways to save money is to automate the process. Here’s how:

Set Up Automatic Transfers

Arrange for a set amount to be transferred from your checking account to your savings account every payday. This way, you won’t be tempted to spend that money.

Utilize High-Interest Savings Accounts

Look for savings accounts that offer higher interest rates. This can help your savings grow faster without any extra effort.

Step 3: Cut Unnecessary Expenses

Evaluate your spending habits and identify areas where you can easily reduce costs. Here are some suggestions:

Grocery Shopping

Food expenses can add up quickly. Consider the following tips to save:

- Plan meals ahead of time

- Buy in bulk

- Use coupons and cashback apps

- Shop seasonal produce

Transportation Costs

Transportation can be a significant expense. Here’s how you can save:

- Carpool with colleagues or friends

- Use public transport when possible

- Negotiate fuel prices or consider telecommuting

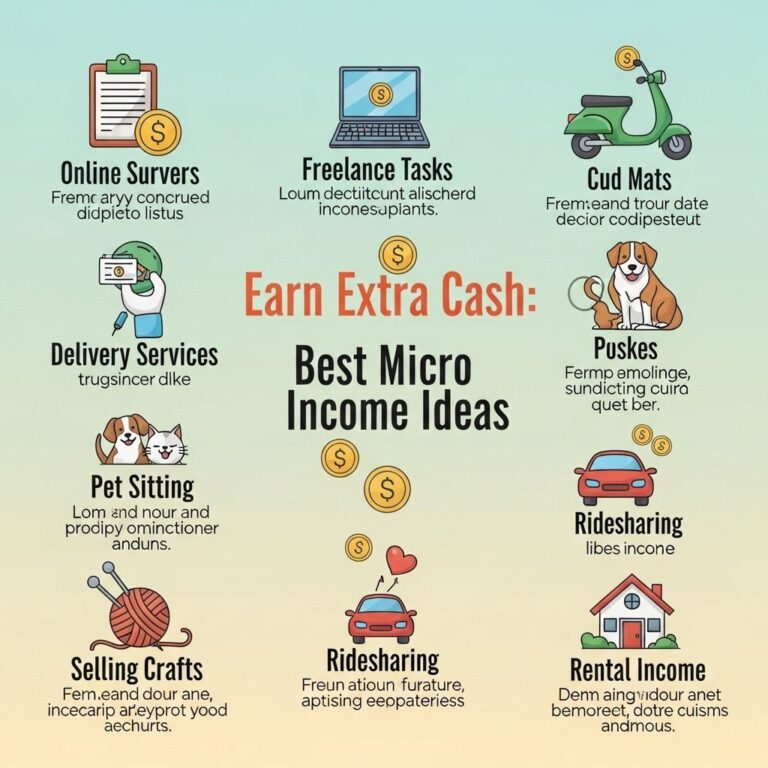

Step 4: Increase Your Income

While cutting expenses is crucial, increasing your income can significantly boost your savings. Here are a few ideas:

Freelancing and Side Gigs

Consider taking on freelance work or a part-time job. Websites like Upwork and Fiverr allow you to offer your skills remotely.

Sell Unused Items

Look around your home for items you no longer need. Popular platforms for selling include:

- eBay

- Facebook Marketplace

- Craigslist

Step 5: Monitor Your Progress

Keeping track of your savings progress is essential for staying motivated. Implement these techniques:

Set Milestones

Break your savings goal into smaller milestones. For example, aim to save $500 in the first month. Celebrate these achievements to stay motivated.

Review and Adjust Your Budget Regularly

Every month, review your budget to see if adjustments are necessary. If you find extra room to save, don’t hesitate to increase your savings rate.

Conclusion

Saving $3,000 quickly is indeed achievable with the right approach. By creating a budget, automating your savings, cutting unnecessary expenses, increasing your income, and monitoring your progress, you can reach your goal sooner than you think. Remember, consistency and discipline are key in your journey toward financial stability.

FAQ

What are the best strategies to save $3,000 quickly?

To save $3,000 quickly, consider creating a strict budget, cutting unnecessary expenses, increasing your income through side jobs, setting up a dedicated savings account, and automating your savings.

How can I cut expenses to save money fast?

You can cut expenses by reducing dining out, canceling unused subscriptions, shopping sales, and limiting impulse purchases.

Are there any quick ways to earn extra income?

Yes, you can earn extra income by freelancing, taking on part-time jobs, selling unused items, or participating in online surveys.

How can I stay motivated while saving money?

Stay motivated by setting clear goals, tracking your progress, rewarding yourself for milestones, and sharing your goals with friends or family for accountability.

What type of savings account is best for quick savings?

A high-yield savings account is ideal for quick savings as it offers better interest rates compared to traditional accounts, helping your money grow faster.

How long will it take to save $3,000 using these methods?

The time it takes to save $3,000 depends on your income, expenses, and commitment to saving, but with discipline, you can achieve this goal in a few months.