In today’s fast-paced world, financial stability is more important than ever. Many individuals find themselves in situations where saving money becomes a priority, but they often feel overwhelmed by the process. Whether it’s planning for a vacation, building an emergency fund, or paying off debt, saving a targeted amount like $1,000 can be a significant milestone. Fortunately, achieving this goal can be simplified into five straightforward steps. Below, we delve into practical strategies that can help you save $1,000 effectively and efficiently.

Table of Contents

Step 1: Set a Clear Savings Goal

The first step in the process of saving $1,000 is to define a clear and actionable savings goal. Setting a specific target can motivate you to make necessary adjustments to your spending habits. Here are some tips on how to establish a clear goal:

- Define Your Purpose: Understand why you want to save this amount. Is it for a special occasion, an emergency fund, or a personal project?

- Set a Timeline: Decide when you want to achieve your savings goal. This could be in three months, six months, or a year.

- Be Realistic: Ensure that your goal is attainable within your financial means to avoid frustration.

Examples of Specific Savings Goals

| Goal | Timeline | Monthly Savings Required |

|---|---|---|

| Emergency Fund | 6 months | $167 |

| Vacation | 12 months | $84 |

| New Laptop | 4 months | $250 |

Step 2: Analyze Your Current Spending

Once you have a clear goal, the next step is to take a close look at your current spending habits. Understanding where your money goes is crucial in identifying areas where you can cut back. Follow these steps:

- Track Your Expenses: Use budgeting apps or spreadsheets to monitor daily expenses.

- Categorize Spending: Divide your expenses into essential (e.g., rent, groceries) and non-essential categories (e.g., entertainment, dining out).

- Identify Patterns: Look for trends in your spending to see where you can make cuts.

Tools for Tracking Expenses

Here are some popular tools and apps that can help you track your expenses:

- Mint: An all-in-one finance app that tracks expenses and helps create budgets.

- YNAB (You Need a Budget): A budgeting tool focused on proactive money management.

- Excel/Google Sheets: For those who prefer manual tracking, spreadsheets can be customized to suit individual needs.

Step 3: Create a Budget

With an understanding of your spending patterns, it’s time to create a budget that aligns with your savings goal. A well-defined budget will help you allocate your income efficiently and ensure that you are setting aside the necessary funds for your savings. Follow these steps to create an effective budget:

- Calculate Your Income: Determine your total monthly income, including any side hustles or freelance work.

- List Expenses: Write down all of your fixed and variable expenses.

- Allocate Funds: Based on your expenses and savings goal, allocate a portion of your monthly income to savings.

Budgeting Template

You can structure your budget using a simple template like this:

| Category | Amount |

|---|---|

| Income | $3,000 |

| Fixed Expenses | $1,500 |

| Variable Expenses | $800 |

| Savings Goal | $700 |

Step 4: Cut Unnecessary Expenses

After creating your budget, analyze it to determine where you can make cuts. This might require some lifestyle changes, but the rewards of saving $1,000 will be worth the sacrifice. Consider the following strategies:

- Eat In: Reduce the frequency of dining out. Cooking meals at home can save you a substantial amount.

- Cancel Subscriptions: Review your subscriptions (streaming services, magazines, etc.) and eliminate those you don’t use.

- Shop Smart: Look for discounts, use coupons, and consider thrift shopping instead of buying new.

Tips for Reducing Monthly Bills

In addition to cutting discretionary spending, you can also reduce fixed expenses:

- Shop around for better rates on insurance.

- Consider renegotiating bills with service providers (internet, cable, etc.).

- Evaluate your housing situation—could you downsize or find a roommate?

Step 5: Increase Your Income

If cutting expenses alone isn’t enough to reach your savings goal, consider finding ways to increase your income. This can be done through various means:

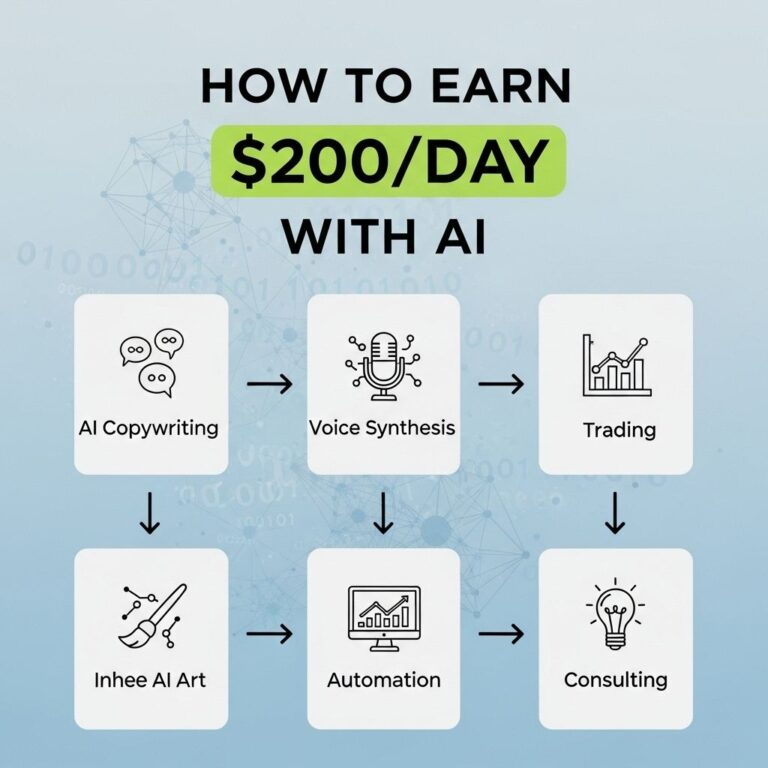

- Side Hustles: Engage in freelance work, tutoring, or selling handmade products online.

- Part-Time Jobs: Look for part-time opportunities that can fit around your current schedule.

- Sell Unused Items: Clear out items you no longer need and sell them through platforms like eBay or Facebook Marketplace.

Potential Side Hustle Ideas

Here are some side hustles to consider:

- Freelancing: Offer your skills (writing, graphic design, etc.) on platforms like Upwork or Fiverr.

- Delivery Services: Work for companies like DoorDash or Grubhub.

- Online Tutoring: Help students in subjects you excel in through services like Tutor.com.

Conclusion

Saving $1,000 doesn’t have to be a daunting task. By following these five simple steps—setting a clear goal, analyzing spending, creating a budget, cutting unnecessary expenses, and considering income opportunities—you can reach your savings target more easily than you might think. Start small, stay consistent, and watch your savings grow over time. Financial independence is achievable, and with dedication, you can turn your $1,000 savings goal into a stepping stone towards greater financial success.

FAQ

What are the best ways to save $1,000 quickly?

To save $1,000 quickly, start by creating a budget, cutting unnecessary expenses, setting up a separate savings account, automating your savings, and finding additional sources of income.

How can I cut expenses to save $1,000?

You can cut expenses by reviewing your monthly bills, canceling subscriptions you don’t use, cooking at home instead of dining out, and shopping with a list to avoid impulse purchases.

Is it possible to save $1,000 in one month?

Yes, it’s possible to save $1,000 in one month by implementing strict budgeting, reducing discretionary spending, and potentially taking on part-time work or side gigs.

What are some effective budgeting methods to save money?

Some effective budgeting methods include the 50/30/20 rule, zero-based budgeting, and using budgeting apps to track your spending and savings goals.

How can I automate my savings to reach $1,000?

You can automate your savings by setting up automatic transfers from your checking account to a savings account each payday, ensuring that a portion of your income goes directly into savings.