NFTs, or non-fungible tokens, have taken the digital world by storm, creating new opportunities for artists, collectors, and investors alike. As the market continues to mature, more individuals are exploring ways to earn passive income through NFTs. This article delves into the most effective strategies for leveraging NFTs for passive earnings, offering insights into the mechanics of these assets and how to capitalize on their potential.

Table of Contents

Understanding NFTs and Passive Income

Before diving into the strategies, it’s essential to grasp what NFTs are and how they function. NFTs represent ownership of a unique digital asset, secured on a blockchain. Unlike cryptocurrencies, which are fungible and can be exchanged one-for-one, NFTs are distinct, which contributes to their value.

Passive income from NFTs entails earning money without active involvement. This can be achieved through various methods, including staking, renting, or even earning royalties on secondary sales. Here’s a breakdown of how these avenues work:

Key Concepts of Passive NFT Earnings

- Staking: Some platforms allow users to stake their NFTs in return for rewards, usually in cryptocurrency.

- Renting: Owners can rent out their NFTs for others to use, providing a steady income stream.

- Royalties: Many NFT sales come with built-in royalties for the original creators, allowing them to earn from secondary sales.

Top Strategies for Earning Passive Income with NFTs

1. Staking NFTs

Staking involves locking your NFTs in a platform that offers rewards for doing so. This mechanism is akin to traditional staking with cryptocurrencies, where you contribute to network security in exchange for rewards.

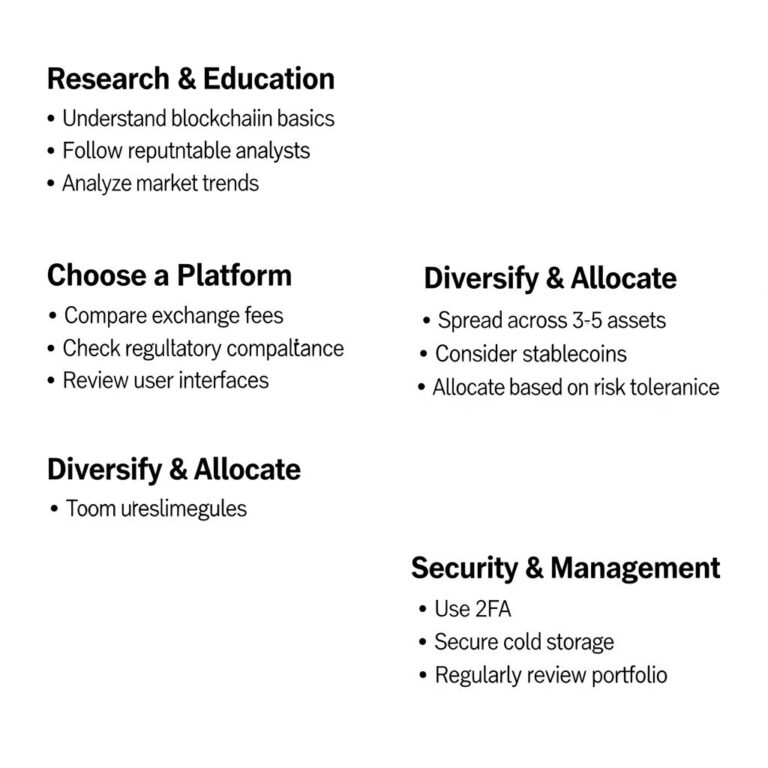

Here’s a step-by-step guide on how to stake NFTs:

- Select a Platform: Choose a platform that supports NFT staking. Popular options include Axie Infinity and My Neighbor Alice.

- Transfer NFTs: Move your NFTs to the chosen platform’s wallet.

- Stake: Follow the platform instructions to stake your NFTs.

- Earn Rewards: Wait for the staking period to end and claim your rewards.

2. Renting Out Your NFTs

Renting NFTs has emerged as a lucrative model, particularly in gaming and virtual worlds. Players can rent NFTs (like characters or tools) that they do not own for a fee.

To effectively rent out your NFTs:

- Identify Demand: Research which NFTs are in demand for rental.

- Platform Choice: Use platforms like NFTfi or Rarible that support NFT rentals.

- Set Terms: Clearly define rental terms, including duration and pricing.

3. Earning Royalties through Resales

Many NFT marketplaces allow creators to set a royalty percentage on secondary sales. This means that every time your NFT is resold, you earn a percentage of the sale price without any additional effort.

To maximize royalty earnings, consider the following:

- Set Competitive Royalties: Typical royalty rates range from 5% to 15%. Analyze your market to set an attractive yet profitable rate.

- Promote Your Work: Utilize social media and other channels to promote your NFTs to increase visibility and likelihood of resale.

- Engage with Buyers: Building relationships can lead to more sales and higher-value transactions.

Exploring Digital Real Estate

Digital real estate refers to virtual plots of land in blockchain-based games and metaverse platforms. Owning these parcels can provide passive income through leasing or hosting events.

Considerations for Investing in Digital Real Estate

| Factor | Description |

|---|---|

| Location | Prime locations tend to attract more visitors and generate higher rental income. |

| Platform Popularity | Invest in well-established platforms to ensure stability and growth potential. |

| Future Developments | Look for platforms that have upcoming features or expansions that can increase property value and income potential. |

Creating NFT Collections

Creating and selling NFT collections can also lead to passive income, especially if you build a fanbase that actively seeks out your work.

Steps to Create a Successful NFT Collection

- Concept Development: Identify a unique theme or concept that resonates with potential buyers.

- Quality Design: Invest in high-quality artwork and design to stand out in a crowded market.

- Marketing: Implement a marketing strategy that includes social media promotion, collaborations with influencers, and participation in NFT communities.

Conclusion

The NFT landscape is ever-evolving, presenting numerous opportunities for passive income. By utilizing strategies such as staking, renting, leveraging royalties, investing in digital real estate, and creating appealing NFT collections, individuals can tap into this lucrative market. As with any investment, it’s crucial to conduct thorough research and stay informed about market trends to navigate this exciting frontier successfully.

FAQ

What are the best NFT strategies for generating passive income?

Some effective NFT strategies for passive earnings include leveraging NFT staking, participating in yield farming, and creating fractional ownership of NFTs.

How does NFT staking work for passive income?

NFT staking allows you to lock up your NFTs in a decentralized platform to earn rewards, typically in the form of tokens or additional NFTs.

Can I earn passive income from NFT royalties?

Yes, many NFT platforms allow creators to earn royalties on secondary sales, providing a continuous stream of income as their NFTs are sold.

What is yield farming in the context of NFTs?

Yield farming refers to the practice of lending or staking NFTs to earn interest or rewards, often in the form of cryptocurrency.

Is fractional ownership of NFTs a viable strategy for passive earnings?

Yes, fractional ownership allows multiple investors to own a share of an NFT, enabling them to earn a portion of the income generated from the asset.

How can I maximize my passive earnings from NFTs?

To maximize passive earnings, diversify your NFT investments, participate in various earning opportunities like staking and royalties, and stay updated on market trends.