Understanding the stock market is essential for anyone looking to build wealth and achieve financial independence. Mastering the basics of stock trading and investing can seem daunting at first, but with the right knowledge and strategies, you can navigate this complex landscape with confidence. This article will guide you through the fundamental concepts of the stock market, key strategies for investment, and tips for becoming a successful trader.

Table of Contents

What is the Stock Market?

The stock market is a platform where investors can buy and sell shares of publicly traded companies. These shares represent ownership in a company and can provide both dividends and capital gains. The stock market is crucial for the overall economy, facilitating capital formation and enabling companies to raise funds for expansion.

Key Components of the Stock Market

- Stocks: Shares of ownership in a company.

- Bonds: Loans made by investors to borrowers, typically corporations or governments.

- Exchanges: Platforms such as the New York Stock Exchange (NYSE) or NASDAQ where stocks are traded.

- Indices: Benchmarks such as the S&P 500 or Dow Jones Industrial Average that track the performance of a selection of stocks.

How to Get Started in the Stock Market

Before diving into trading, it’s important to take foundational steps that will prepare you for success:

1. Set Your Financial Goals

Establishing clear financial goals will help you determine your investment strategy. Consider the following:

- What is your investment timeline? (short-term vs. long-term)

- What is your risk tolerance? (high risk vs. low risk)

- What are your ultimate financial objectives? (retirement, buying a home, etc.)

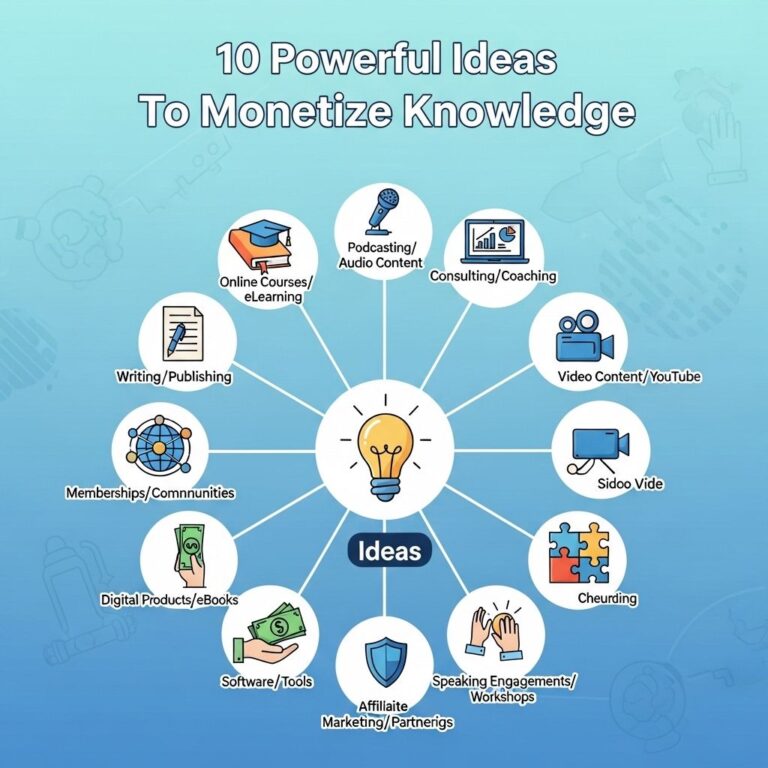

2. Educate Yourself

Investing in knowledge is as critical as investing capital. Here are some resources to consider:

- Books: Titles like “The Intelligent Investor” by Benjamin Graham.

- Online Courses: Websites like Coursera or Khan Academy offer structured learning.

- Podcasts: Tune into finance and investment-related podcasts for insights from experts.

3. Choose a Brokerage

Your brokerage acts as an intermediary between you and the stock market. When selecting a brokerage, consider:

- Commission fees: Look for competitive rates.

- Platform features: Choose a platform that suits your trading style.

- Customer service: Ensure support is available when needed.

Understanding Stock Market Terminology

Familiarizing yourself with common stock market terms is essential. Here are some key definitions:

| Term | Definition |

|---|---|

| Bear Market | A market characterized by declining prices. |

| Bull Market | A market with rising prices. |

| Dividends | Payments made by a corporation to its shareholders. |

| Market Capitalization | The total market value of a company’s outstanding shares. |

| IPO | Initial Public Offering – the first sale of stock by a company. |

Types of Investment Strategies

Investors employ various strategies to achieve their financial goals. Here are some common ones:

1. Value Investing

This strategy involves picking undervalued stocks that have strong fundamentals and are expected to perform well in the long run.

2. Growth Investing

Growth investors seek companies that are expected to grow at an above-average rate compared to their industry. These often do not pay dividends as profits are reinvested into the business.

3. Index Investing

This passive investment strategy aims to replicate the performance of a specific index, such as the S&P 500, by purchasing the same stocks in the same proportions.

Risk Management and Diversification

One of the most crucial aspects of investing is managing risk. Diversification is a powerful tool for minimizing risk:

Benefits of Diversification

- Reduces volatility: Spreading investments across different asset classes can help stabilize returns.

- Lower risk: Different sectors respond differently to market conditions.

- Improved returns: A diversified portfolio can lead to better long-term performance.

Simple Ways to Diversify

- Invest across different sectors (e.g., technology, healthcare, finance).

- Include various asset classes (e.g., stocks, bonds, ETFs).

- Consider international markets for exposure to foreign investments.

Monitoring Your Investments

Once you’ve made your investments, it’s vital to keep an eye on your portfolio:

1. Regular Check-ups

Set a regular schedule to review your portfolio (monthly or quarterly).

2. Stay Informed

Follow market news and trends that may impact your investments.

3. Rebalance Your Portfolio

Adjust your investments to maintain your desired asset allocation, especially after significant market movements.

Conclusion

Mastering the basics of the stock market is a journey that requires education, practice, and patience. By setting clear goals, educating yourself, understanding key terminology, and employing sound investment strategies, you can position yourself for financial success. Remember, the stock market is not just about buying and selling but about making informed decisions that align with your long-term financial aspirations.

FAQ

What are the fundamental concepts of the stock market?

The fundamental concepts of the stock market include understanding stocks, bonds, mutual funds, and exchange-traded funds (ETFs), as well as key terms like market capitalization, dividends, and price-to-earnings (P/E) ratio.

How can beginners start investing in the stock market?

Beginners can start investing in the stock market by opening a brokerage account, educating themselves about stock market basics, starting with a small investment, and considering index funds or ETFs for diversification.

What is the importance of research in stock market investing?

Research is crucial in stock market investing as it helps investors make informed decisions, understand market trends, analyze company performance, and evaluate potential risks and rewards.

What strategies can help in mastering stock market basics?

Strategies to master stock market basics include setting clear investment goals, diversifying your portfolio, staying updated with market news, practicing with virtual trading platforms, and continuously educating yourself.

How does one analyze stocks effectively?

Effective stock analysis involves examining a company’s financial statements, assessing its industry position, evaluating market trends, and using technical analysis tools to identify price movements.

What are some common mistakes to avoid when investing in the stock market?

Common mistakes to avoid when investing in the stock market include emotional trading, lack of research, ignoring fees and expenses, not diversifying, and attempting to time the market.