Cryptocurrency has rapidly evolved from a niche investment to a significant financial instrument that attracts a diverse group of investors. If you have $1,000 to invest in crypto in 2025, the options are varied and potentially lucrative. However, navigating the volatile landscape of digital currencies requires knowledge, strategy, and risk management. This article will guide you through the steps to make informed investment decisions in the cryptocurrency market.

Table of Contents

Understanding the Crypto Landscape

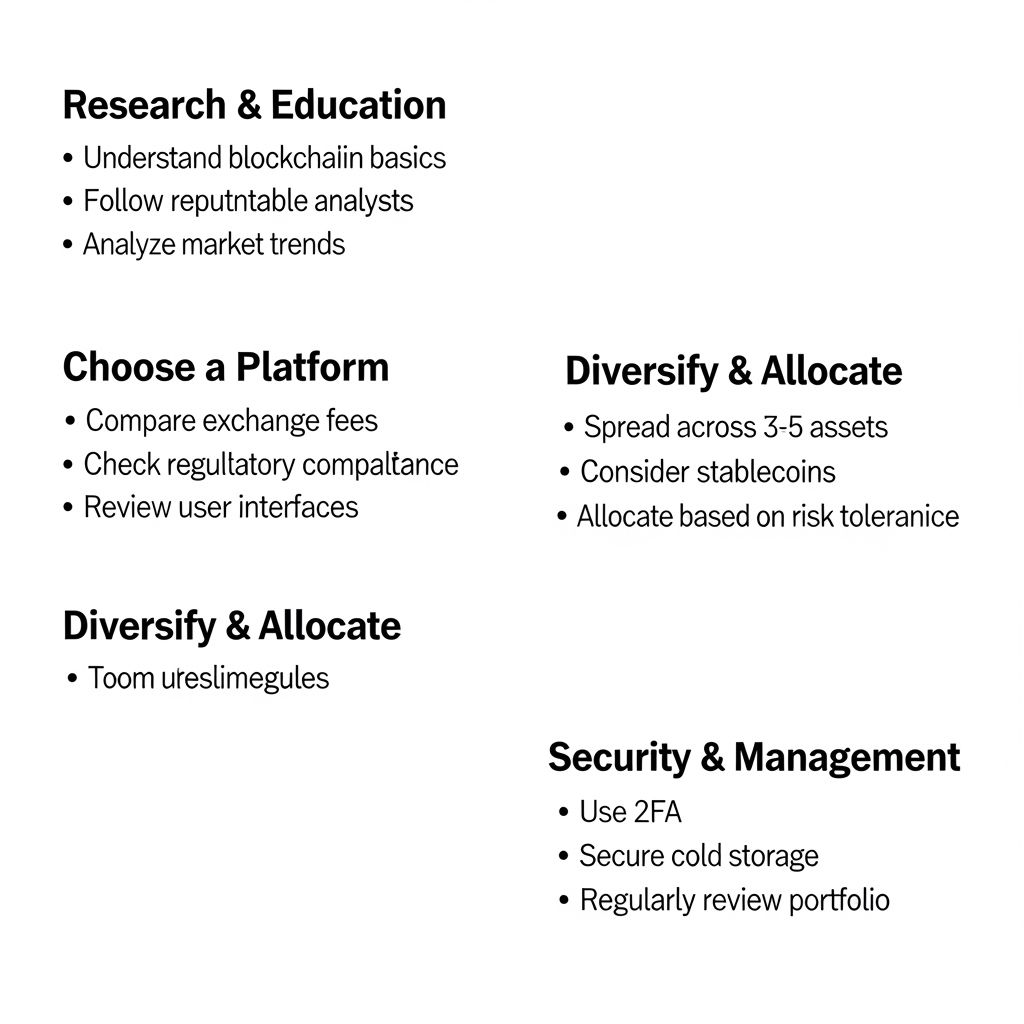

Before diving into specific investments, it’s essential to grasp the fundamentals of cryptocurrency. Here are key concepts to understand:

- Blockchain Technology: The underlying technology that powers cryptocurrencies, allowing for secure transactions and transparent record-keeping.

- Altcoins: Any cryptocurrency other than Bitcoin, with thousands of options available.

- Market Capitalization: A metric used to rank cryptocurrencies, calculated by multiplying the current price by the total supply of coins.

- DeFi (Decentralized Finance): Financial systems that operate without intermediaries, often associated with higher risks and rewards.

Setting Your Investment Goals

Before you invest, consider your financial goals, risk tolerance, and investment horizon. Here are some questions to guide your decision:

- What are your short-term and long-term financial goals?

- How much risk are you willing to take?

- What is your investment timeline?

Diversifying Your Portfolio

One of the most crucial strategies in investing is diversification. Here’s how to spread your $1,000 investment across different assets:

| Asset Type | Percentage Allocation | Amount ($) |

|---|---|---|

| Bitcoin (BTC) | 40% | 400 |

| Ethereum (ETH) | 30% | 300 |

| DeFi Projects | 20% | 200 |

| Stablecoins | 10% | 100 |

Choosing the Right Cryptocurrencies

Investing in crypto involves selecting the right assets. Here are some popular options to consider:

1. Bitcoin (BTC)

The pioneer of cryptocurrencies, Bitcoin remains the most widely recognized asset in the market. Its limited supply and strong network effect make it a solid investment choice.

2. Ethereum (ETH)

Known for its smart contract functionality, Ethereum has gained traction as a platform for decentralized applications. Its upgrade to Ethereum 2.0 aims to improve scalability and reduce energy consumption.

3. DeFi Coins

Decentralized Finance projects like Uniswap (UNI), Aave (AAVE), and Chainlink (LINK) have gained popularity, offering unique financial services without traditional intermediaries. Research their use cases and market potential before investing.

Staying Informed and Analyzing Market Trends

Keeping up with market trends is crucial for making informed investment decisions. Here are ways to stay updated:

- Follow cryptocurrency news websites and blogs for the latest developments.

- Join online forums and social media groups focused on cryptocurrency discussions.

- Utilize market analysis tools and platforms to track price movements and trading volumes.

Understanding Risks

Investing in cryptocurrencies carries inherent risks. Some of these include:

- Volatility: Cryptocurrency prices can fluctuate wildly, leading to significant gains or losses.

- Regulatory Risks: Changes in government regulations can impact the viability of certain cryptocurrencies.

- Security Risks: Hacks and scams are prevalent in the crypto space; ensure to secure your investments.

Best Practices for Investing in Crypto

To maximize your investment potential and minimize risks, consider the following best practices:

- Do Your Own Research (DYOR): Always conduct thorough research on any cryptocurrency you plan to invest in.

- Invest Only What You Can Afford to Lose: Cryptocurrencies can be unpredictable; only invest disposable income.

- Use Reputable Exchanges: Choose well-known platforms for buying and trading cryptocurrencies.

Securing Your Investments

Security is paramount when dealing with cryptocurrencies. Here are some methods to protect your assets:

- Hardware Wallets: Consider using hardware wallets for long-term storage of your crypto assets.

- Two-Factor Authentication (2FA): Always enable 2FA on your exchange accounts for an added layer of security.

- Regular Portfolio Reviews: Periodically assess your investments and adjust your strategy based on market conditions.

Conclusion

Investing $1,000 in cryptocurrency in 2025 can be a rewarding venture if approached with knowledge and caution. By understanding the market, setting clear goals, diversifying your portfolio, and staying informed, you can maximize your chances of achieving financial success in the dynamic world of digital currencies. Remember that patience and continuous learning are vital to becoming a successful investor in the crypto space.

FAQ

What are the best cryptocurrencies to invest in with $1,000 in 2025?

In 2025, consider investing in established cryptocurrencies like Bitcoin and Ethereum, as well as promising altcoins that have shown potential for growth.

How can I safely invest $1,000 in cryptocurrency?

To safely invest $1,000 in cryptocurrency, use reputable exchanges, enable two-factor authentication, and store your assets in a secure wallet.

What is the expected return on investment for crypto in 2025?

While it’s difficult to predict exact returns, many analysts expect the cryptocurrency market to grow significantly, potentially offering high returns on your investment.

Should I invest all $1,000 in one cryptocurrency or diversify?

It’s generally advisable to diversify your investment across multiple cryptocurrencies to mitigate risk and increase the potential for profit.

What are the risks of investing $1,000 in crypto?

Risks include market volatility, regulatory changes, and potential losses due to hacking. It’s essential to conduct thorough research and only invest what you can afford to lose.

How can I stay updated on cryptocurrency trends for 2025?

To stay updated, follow reputable cryptocurrency news websites, join online forums, and subscribe to newsletters that focus on market analyses and trends.