Cryptocurrency has become a beacon of financial opportunity for many, offering a chance to earn substantial income in a decentralized and borderless financial landscape. As the crypto market evolves, so do the strategies to generate consistent monthly returns. In this article, we will delve into effective methods to earn $1,000 a month in crypto, examining different avenues from trading to staking and more.

Table of Contents

Understanding the Crypto Landscape

Before diving into specific strategies, it’s crucial to understand the fundamentals of the cryptocurrency market.

Market Volatility

The crypto market is notorious for its volatility, which can result in significant gains or losses. Understanding market trends is essential for anyone looking to earn a steady income.

Key Terminology

- Altcoins: Any cryptocurrency other than Bitcoin.

- DeFi: Decentralized finance, which aims to recreate traditional financial systems in a decentralized manner.

- Staking: Holding a cryptocurrency in a wallet to support network operations, earning rewards in return.

Strategies to Earn $1,000 a Month

Now that we have a foundational understanding, let’s explore a variety of strategies to earn $1,000 monthly.

1. Day Trading

Day trading involves buying and selling cryptocurrencies within the same day to capitalize on price fluctuations.

Pros and Cons

| Pros | Cons |

|---|---|

| Potential for high profits | High risk of loss |

| Flexible hours | Requires continuous market monitoring |

Getting Started

- Choose a reliable exchange (e.g., Binance, Coinbase).

- Invest in a trading strategy (e.g., technical analysis, news-based trading).

- Start with a small capital to minimize risk.

2. Crypto Staking

If you prefer a more passive approach, crypto staking might be ideal. This involves holding specific cryptocurrencies to support network operations and earn rewards.

Popular Staking Coins

- Ethereum (ETH)

- Cardano (ADA)

- Polkadot (DOT)

How to Stake

- Select a staking platform or wallet that supports your chosen cryptocurrency.

- Transfer your coins to the staking wallet.

- Start earning rewards, usually in the form of additional coins.

3. Yield Farming

Yield farming is another DeFi strategy that allows users to earn more cryptocurrency with their crypto assets.

Steps to Yield Farm

- Find a reliable DeFi platform (e.g., Uniswap, Aave).

- Provide liquidity by depositing cryptocurrencies into liquidity pools.

- Earn interest or tokens for your contributions.

Risks Involved

While yield farming can be lucrative, it also carries risks such as impermanent loss, smart contract vulnerabilities, and market volatility.

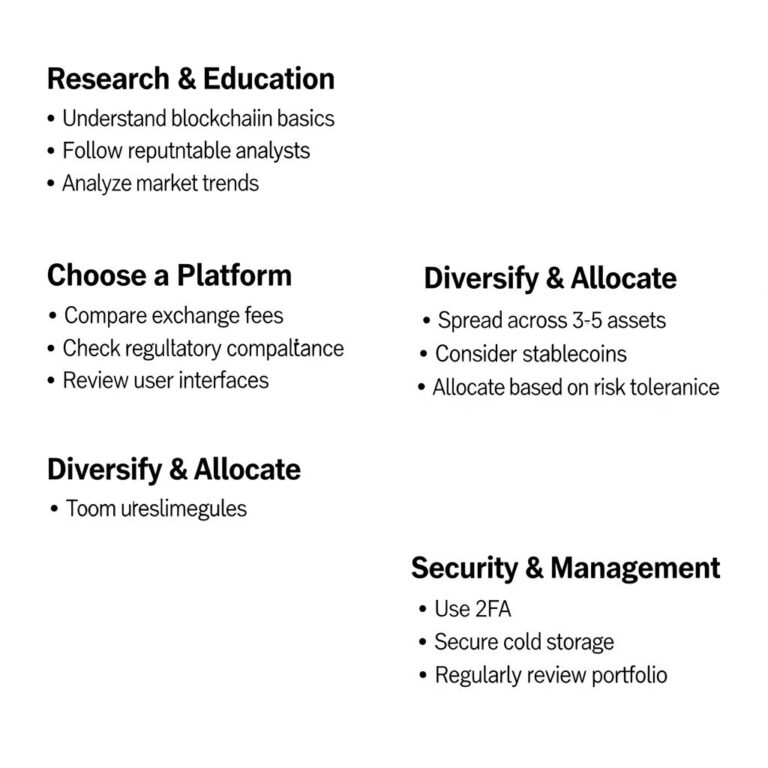

Building a Diverse Portfolio

To mitigate risks and enhance potential profits, it’s wise to create a diversified crypto portfolio.

Asset Allocation

| Category | Percentage Allocation |

|---|---|

| Major Cryptocurrencies (e.g., BTC, ETH) | 50% |

| Altcoins | 30% |

| Stablecoins (for liquidity) | 20% |

Regular Rebalancing

Regularly rebalancing your portfolio ensures that you maintain your desired risk level and capitalize on rising assets.

Leveraging Crypto Education

Staying informed about the latest trends and developments in the cryptocurrency world is key to successful investing and earning.

Resources for Learning

- Online courses (e.g., Coursera, Udemy)

- Crypto news websites (e.g., CoinDesk, CoinTelegraph)

- Community forums (e.g., Reddit, Bitcointalk)

Networking with Other Investors

Joining online communities or local meetups can provide valuable insights and strategies from more experienced investors.

Conclusion

While earning $1,000 a month in crypto is achievable, it requires a combination of strategic planning, risk management, and continuous education. By exploring various avenues like trading, staking, and yield farming, and diversifying your portfolio, you can enhance your chances of financial success in the exciting world of cryptocurrency. Remember, the key to success is not just about making money, but also about understanding the technology and market dynamics that drive the crypto ecosystem.

FAQ

What are the best strategies to earn $1,000 a month in cryptocurrency?

To earn $1,000 a month in crypto, consider strategies such as trading, staking, yield farming, and investing in high-potential altcoins.

Is it possible to earn passive income with cryptocurrency?

Yes, you can earn passive income through staking, lending, and participating in liquidity pools on decentralized finance platforms.

What are the risks associated with earning money in cryptocurrency?

Cryptocurrency investments are highly volatile and risky, with potential for loss due to market fluctuations, scams, and regulatory changes.

How can I start trading cryptocurrency to reach my income goal?

To start trading, choose a reliable exchange, educate yourself on market analysis, and develop a trading strategy that aligns with your risk tolerance.

What are the tax implications of earning money in cryptocurrency?

Earning money in cryptocurrency is subject to taxation; it’s important to keep records of gains and losses and consult with a tax professional.

Are there any specific cryptocurrencies that can help achieve $1,000 a month?

While no specific cryptocurrency guarantees income, researching promising projects and trends can help you identify potential investments.