As a freelancer, managing your finances can be one of the most challenging aspects of your career. Unlike traditional jobs, where income is stable and benefits are provided, freelancers face fluctuating income and the responsibility of managing their own expenses. This article will delve into effective budgeting tips to help freelancers navigate their financial landscape efficiently.

Table of Contents

Understanding Your Income

The first step in budgeting as a freelancer is understanding your income. This involves tracking earnings from different clients and projects over time. Keep in mind that your income may vary month to month, so it’s essential to have a clear picture of your overall financial situation.

1. Track Your Earnings

Utilize tools like spreadsheets, accounting software, or even simple notebooks to keep a detailed record of your income. Consider logging the following:

- Client names

- Project descriptions

- Payment amounts

- Payment dates

2. Calculate Your Average Monthly Income

Once you have a record of your earnings, calculate your average monthly income over the past six months. This will serve as a baseline for budgeting purposes. Here’s how to do it:

- Add up your total earnings for the last six months.

- Divide that number by six.

- This average will help you set realistic budget expectations.

Identifying Your Expenses

Understanding your expenses is crucial for effective budgeting. As a freelancer, your expenses may include both personal and business-related costs.

1. Separate Personal and Business Expenses

Create a clear distinction between personal and business expenses. This not only helps with budgeting but also simplifies tax deductions. Use separate accounts for business transactions whenever possible.

2. List All Monthly Expenses

Compile a comprehensive list of your monthly expenses. Common categories include:

- Rent/Mortgage

- Utilities

- Internet and phone bills

- Software subscriptions

- Office supplies

- Taxes

Creating a Budget Plan

With a clear understanding of both your income and expenses, it’s time to create a budget plan that works for you.

1. Use the 50/30/20 Rule

The 50/30/20 rule is a popular budgeting technique that can be adapted for freelancers. It breaks down your income into three categories:

| Category | Percentage |

|---|---|

| Needs | 50% |

| Wants | 30% |

| Savings/Debt Repayment | 20% |

This method ensures you’re covering your essentials while still allowing for discretionary spending and savings.

2. Set Aside Money for Taxes

As a freelancer, you are responsible for handling your own taxes, which can come as a surprise if not planned for. Here’s how to prepare:

- Estimate your tax rate based on your total income.

- Set aside a percentage of each payment you receive (recommendation: 25-30%).

- Create a separate savings account for tax funds to avoid spending it.

Adjusting Your Budget

Your financial situation as a freelancer can change rapidly. It’s essential to regularly review and adjust your budget.

1. Monitor Your Expenses Monthly

Set a recurring date each month to review your expenses and income. Make adjustments as necessary to ensure you’re staying on track.

2. Raise Your Rates Periodically

If you find you consistently have more work than you can handle, it may be time to raise your rates. Consider evaluating your pricing structure every few months. Factors to consider include:

- Market demand for your services

- Your level of experience

- Client feedback

Building an Emergency Fund

Just as with traditional employment, freelancers should aim to build an emergency fund to cover unexpected expenses or fluctuations in income.

1. Determine Your Target Fund Size

A good rule of thumb is to save three to six months’ worth of living expenses. This will provide a safety net when income dips.

2. Automate Savings

Set up automatic transfers to your emergency fund account every month. Treat this as a non-negotiable expense just like rent or utility bills.

Investing in Your Future

Finally, as a freelancer, it’s essential to think long-term about your financial future.

1. Retirement Accounts

Consider opening a retirement savings account tailored for self-employed individuals, such as a SEP IRA or Solo 401(k). These accounts offer tax advantages and can significantly impact your financial future.

2. Continuous Learning

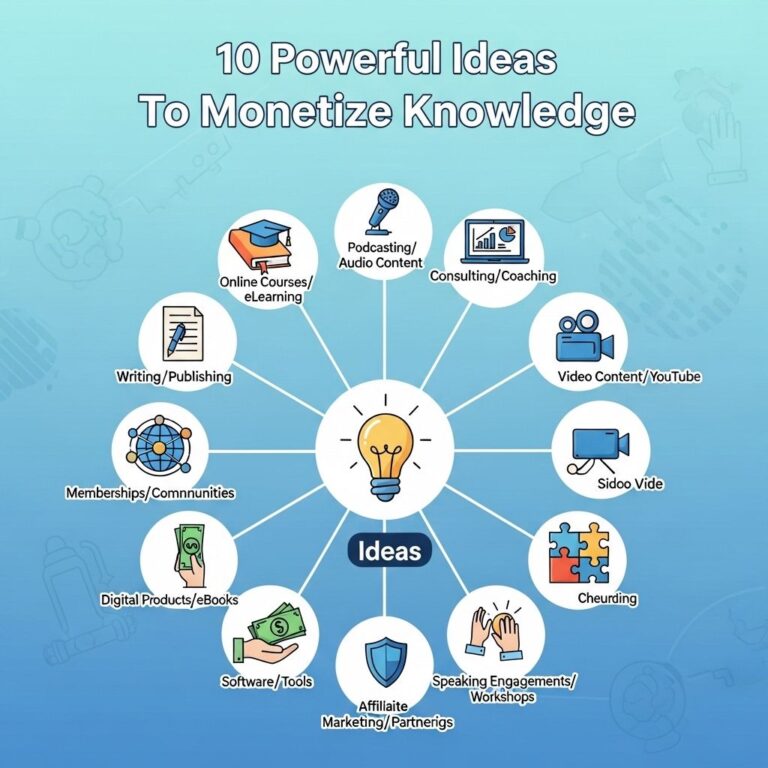

Investing in your skills can lead to better opportunities and higher income. Allocate part of your budget towards professional development, such as:

- Online courses

- Workshops

- Conferences

Conclusion

Managing finances as a freelancer can seem daunting, but with a structured budgeting plan and consistent monitoring, it is possible to achieve financial stability. By understanding your income, tracking your expenses, adjusting your budget, and preparing for the future, you can thrive in your freelance career with confidence. Remember, the key to successful budgeting lies in flexibility and adaptability to changing circumstances.

FAQ

What are effective budgeting tips for freelancers?

Effective budgeting tips for freelancers include tracking all income and expenses, setting aside a specific percentage for taxes, creating a separate savings account for business expenses, using budgeting software, and reviewing your budget regularly.

How can freelancers manage irregular income?

Freelancers can manage irregular income by creating a cash reserve, setting a minimum monthly income goal, and adjusting their budget according to seasonal fluctuations in work.

What percentage of income should freelancers save for taxes?

Freelancers should typically save about 25-30% of their income for taxes, but it’s important to consult with a tax professional for personalized advice.

What tools can help freelancers with budgeting?

Tools that can help freelancers with budgeting include apps like QuickBooks, Mint, and YNAB (You Need a Budget), which can track income, expenses, and overall budget goals.

How often should freelancers review their budget?

Freelancers should review their budget at least monthly to adjust for any changes in income or expenses and ensure they are on track with their financial goals.

What are some common budgeting mistakes freelancers make?

Common budgeting mistakes freelancers make include underestimating expenses, neglecting to save for taxes, failing to track all income sources, and not adjusting budgets for fluctuating workloads.